Have you ever called a company to pay a bill or to check account information and heard an automated voice system giving you options to choose from?

That automated system is called an Interactive Voice Response (IVR) system, and it allows you to make payments or access account details using just your phone’s keypad or voice commands.

What is an IVR Payment?

An IVR payment is a method of making payments over the phone through an automated Interactive Voice Response system.

Instead of speaking to a live customer service agent, you interact with a computer system that guides you through the payment process using pre-recorded voice prompts and your phone’s keypad or voice commands.

How Does It Work?

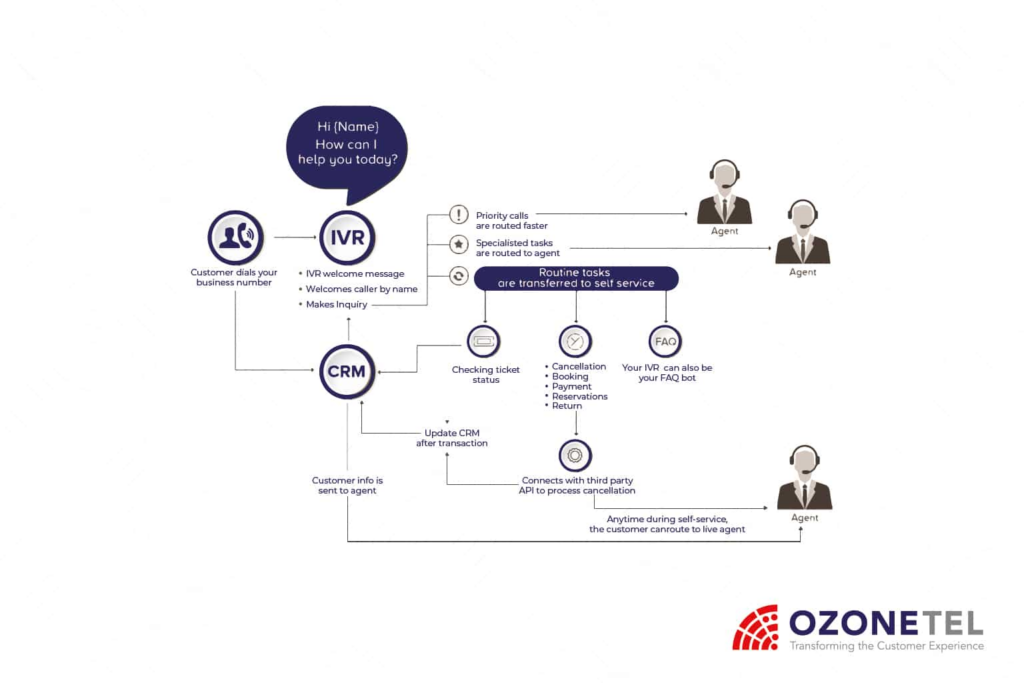

When you call a company’s customer service line, the IVR system will greet you with a recorded message and present you with a menu of options. For example, it might say, “Press 1 to make a payment, press 2 for account information,” and so on.

If you choose the payment option, the system will then prompt you to enter your account or payment information, such as your account number, payment amount, and payment method (credit card, debit card, or bank account information).

The system will guide you through each step, asking you to input the required information using your phone’s keypad or by speaking the information if voice recognition is enabled.

Once you’ve provided all the necessary information, the IVR system will process your payment and provide you with a confirmation number or receipt for your records.

Types of IVR Payment Options

Sure, here are the details on the two main types of IVR payment options – agent-assisted and self-service:

1. Agent Assisted IVR Payments:

In an agent-assisted IVR payment, the customer interacts with the automated system initially but has the option to transfer to a live customer service agent to complete the payment process.

How does Agent Assisted IVR Payments work?

- The customer calls the company’s customer service line and is greeted by the IVR system.

- They navigate through the menu options using voice commands or keypad inputs.

- At some point, the IVR system will provide an option to speak with a live agent (e.g., “Press 0 to speak with an agent”).

- If the customer selects this option, they will be transferred to a customer service representative.

- The agent can then assist the customer in making the payment, providing guidance and answering any questions.

- The agent will collect the necessary payment information (credit card, bank account, etc.) and process the payment on the customer’s behalf.

2. Self-Service IVR Payments:

A self-service IVR payment allows the customer to complete the entire payment process through the automated system without the need for human assistance.

How does it work?

- The customer calls the company’s customer service line and interacts with the IVR system.

- The IVR system provides prompts and menu options related to making a payment.

- The customer follows the prompts, entering information like their account number, payment amount, and payment method (credit card, bank account, etc.) using the phone’s keypad or voice commands.

- The IVR system securely collects and processes the payment information without the involvement of a live agent.

- Upon successful payment, the system provides a confirmation number or receipt details.

The self-service option is often preferred by customers who value convenience and the ability to complete transactions quickly without having to speak to an agent.

However, the agent-assisted option is beneficial for customers who require additional assistance, have complex inquiries, or prefer human interaction for sensitive transactions.

Both agent-assisted and self-service IVR payment options aim to provide customers with efficient and secure ways to make payments over the phone, catering to different preferences and needs.

Are IVR Payments Really Secure?

IVR payments are generally considered secure when proper precautions and security measures are implemented by the service provider.

However, as with any transaction involving sensitive financial information, it’s important to understand the potential risks and take necessary steps to protect yourself.

- Encryption: Reputable IVR systems use encryption technologies to protect the data transmitted during the payment process. Encryption scrambles the information, making it unreadable to unauthorized parties who may intercept the data.

- Payment Card Industry Data Security Standard (PCI DSS) Compliance: Companies that handle credit card payments, including through IVR systems, are required to comply with the PCI DSS standards. These standards outline a set of security requirements designed to protect cardholder data and ensure secure transactions.

- Tokenization: Some IVR systems may use tokenization, which replaces sensitive payment information with a unique token or code. This token is then used for processing the payment, reducing the risk of exposing actual payment details.

- Secure Transmission: IVR payments should be conducted over secure communication channels, such as encrypted phone lines or secure internet connections, to prevent eavesdropping or interception of data.

- Limited Data Exposure: Well-designed IVR systems minimize the exposure of sensitive payment information by asking for only the necessary details (e.g., credit card number and expiration date) and not storing or transmitting additional unnecessary data.

- Authentication: Many IVR systems require customers to authenticate their identity before processing payments, typically by providing account numbers, PINs, or other verification methods.

Always verify the legitimacy of the company you’re dealing with, be cautious of unsolicited calls or requests for payment, and never provide personal or financial information unless you initiated the call and trust the recipient.

Additionally, it’s a good practice to monitor your account statements regularly for any unauthorised charges or suspicious activity and report any concerns promptly to the appropriate authorities or financial institutions.

Benefits of IVR Payments

IVR (Interactive Voice Response) payments offer several significant benefits for both customers and businesses.

1. Convenience and 24/7 Accessibility

One of the most notable benefits of IVR payments is the convenience and accessibility they provide.

Customers can make payments at any time of the day or night, without being restricted by business hours or the availability of live customer service agents. This flexibility is particularly beneficial for individuals with busy schedules or those who prefer to handle transactions outside of regular business hours.

IVR payments eliminate the need for customers to physically visit a payment center or wait in long queues. They can complete transactions from the comfort of their homes or on-the-go, using their mobile phones.

This convenience factor enhances customer satisfaction and reduces the stress and time associated with traditional payment methods.

2. Increased Efficiency and Cost Savings

IVR payment systems are automated, which means they can handle a large volume of transactions simultaneously without the need for human intervention.

This increased efficiency translates into significant cost savings for businesses, as they can reduce the number of customer service representatives required to handle routine payment transactions.

Additionally, they can streamline the payment process by guiding customers through a series of prompts and eliminating the need for extensive human interaction.

This efficiency not only saves time for customers but also reduces operational costs for businesses, as fewer resources are required to process payments.

3. Enhanced Security and Fraud Prevention

Reputable IVR payment systems employ advanced security measures to protect sensitive financial information.

These measures include encryption techniques that scramble data during transmission, tokenization that replaces sensitive data with secure tokens, and compliance with industry standards such as the Payment Card Industry Data Security Standard (PCI DSS).

They can incorporate additional authentication measures, such as requiring customers to enter account numbers, PINs, or other verification methods before processing payments.

These security measures help prevent unauthorized access to financial information and reduce the risk of fraud.

4. Self-Service Capabilities and Reduced Wait Times

IVR payments empower customers with self-service capabilities, allowing them to complete transactions independently without the need for human assistance.

This not only enhances customer autonomy but also reduces wait times and call volumes for customer service centers.

By offloading routine payment transactions to the IVR system, businesses can prioritize their customer service resources for more complex inquiries or issues that require human intervention. This results in shorter wait times for customers seeking personalized assistance, leading to improved overall customer satisfaction.

5. Detailed Record-Keeping and Reporting

IVR payment systems typically provide detailed records and reports of all transactions processed through the system. This includes information such as payment amounts, dates, payment methods, and confirmation numbers or receipts.

These detailed records not only assist customers in tracking their payments but also enable businesses to maintain accurate financial records and audit trails. This data can be invaluable for reconciliation purposes, dispute resolution, and overall financial management.

IVR payments offer a wide range of benefits that contribute to increased customer satisfaction, operational efficiency, and cost savings for businesses.

By leveraging the convenience, security, and self-service capabilities of IVR payment systems, organisations can streamline their payment processes while providing a seamless and secure experience for their customers.

Who Should Use IVR Payments?

IVR (Interactive Voice Response) payments can be beneficial for a wide range of individuals and businesses across various industries. Here are some scenarios where using IVR payments can be advantageous:

- Businesses with High Volume of Routine Payments Companies that receive a large number of routine payments, such as utility providers, telecommunications companies, insurance firms, and subscription-based services, can greatly benefit from implementing IVR payment systems. By automating the payment process, these businesses can reduce the workload on customer service representatives and streamline their operations, leading to cost savings and improved efficiency.

- Organizations with Extended Customer Service Hours For businesses that offer customer support outside of regular business hours, IVR payments provide a convenient solution for customers to make payments at any time of day or night. This is particularly useful for industries like healthcare, emergency services, and companies with a global customer base spanning multiple time zones.

- Individuals Preferring Self-Service Options Many customers appreciate the ability to complete transactions independently without the need for human interaction. IVR payments cater to these individuals by offering a self-service option, allowing them to make payments at their convenience without having to speak to a customer service agent.

- Customers with Mobility or Accessibility Challenges IVR payments can be particularly beneficial for individuals with mobility or accessibility challenges, as they can make payments from the comfort of their homes or wherever they have access to a phone. This eliminates the need for physically visiting a payment center or waiting in queues.

- Businesses Handling Sensitive Financial Information Organizations that deal with sensitive financial information, such as banks, credit card companies, and financial institutions, can leverage the security features of IVR payment systems. These systems often employ advanced encryption techniques, tokenization, and compliance with industry standards to protect sensitive data and reduce the risk of fraud.

- Nonprofit Organizations: Nonprofit organizations and charities can utilize IVR payment systems to streamline donations and recurring payments from supporters. This convenient option can encourage more individuals to contribute to their causes, as it eliminates the need for in-person or mail-based donations.

While IVR payments may not be suitable for every business or individual, they offer a convenient, secure, and efficient payment solution for a wide range of scenarios.

By evaluating their specific needs and customer preferences, organizations can determine whether implementing an IVR payment system would be beneficial for their operations and customer experience.

The Bottom Line

IVR payments offer a convenient, secure, and efficient way for customers to make payments over the phone through automated voice response systems.

By leveraging features like encryption, tokenization, and compliance with industry standards, IVR systems protect sensitive financial data while enabling self-service capabilities.

With 24/7 accessibility, reduced wait times, and detailed record-keeping, IVR payments benefit both customers and businesses across various industries.

As digital transactions continue to rise, using IVR payment solutions allow organisations to streamline operations, enhance customer experiences, and stay competitive in this market.

FAQs

Ques 1. What does IVR mean in payments?

Ans: In the context of payments, IVR (Interactive Voice Response) refers to a system that allows customers to make payments over the phone using voice prompts and keypad inputs.

Ques 2. What is the IVR payment line?

Ans: An IVR payment line is a dedicated phone number provided by a company or institution for customers to call and make payments using an automated IVR system.

Ques 3. How do banks use IVR?

Ans: Banks use IVR systems to automate routine banking transactions, such as account balance inquiries, credit card payments, and loan applications, reducing the need for human agents.

Ques 4. Why do companies use IVR?

Ans: Companies use IVR systems to provide 24/7 self-service options for customers, improve customer experience, reduce operational costs, and efficiently handle high call volumes.